Tips & Advice

We are pleased to provide a variety of resources on accounting, taxation and other related subjects that we hope will be helpful to both individuals and businesses. Read through our blog posts below or browse through our Quick Tools resource menu. Have a question that isn’t answered here? We can help. Simply contact us by email or give us a call at 807-276-6272. We would be happy to meet with you for a free, no-obligation consultation.

Disclaimer:

The content provided in this blog is for general informational purposes only and is not intended as professional accounting, tax, or financial advice. While efforts are made to ensure the accuracy and timeliness of the content, errors or omissions may occur. The content does not constitute a client-advisor relationship. Readers should consult with a Chartered Professional Accountants or other financial professional for advice tailored to their specific needs. We are not liable for any actions one might take based on the information provided in this blog.

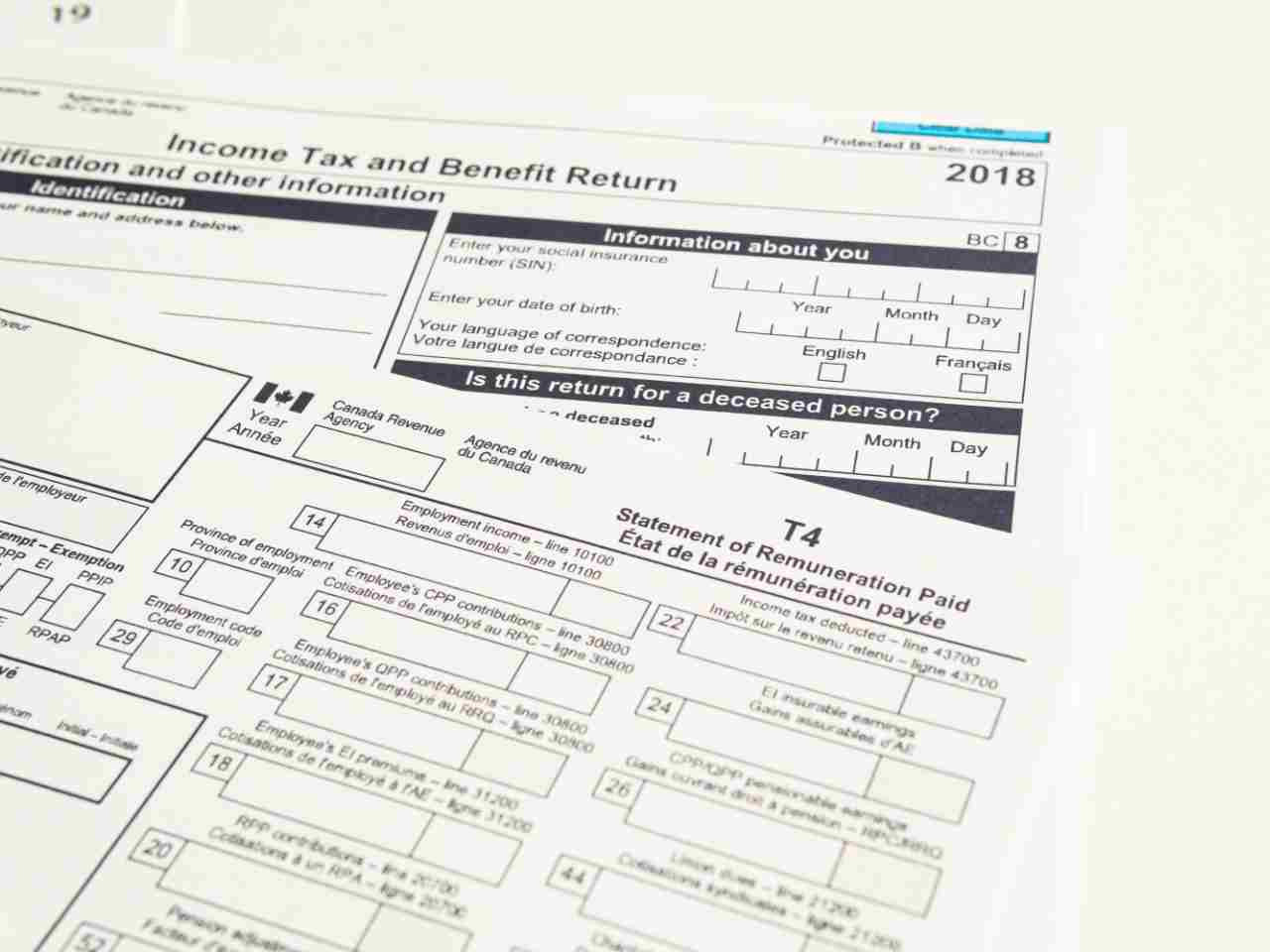

What Documents Do I Need for Tax Season?

What documentation should you include with your return and which records should you maintain? If filing electronically, retain all receipts and documents as the CRA may request them later. For paper filings, the information provided will specify necessary attachments like certificates, forms, schedules, or receipts. It's advisable to retain all receipts and documents for at least six years post-filing to accommodate potential CRA reviews.

Regarding record-keeping, it's prudent to keep copies of your return, the associated notice of assessment, and any notice of reassessment. These documents aid in completing subsequent returns, incorporating details like unused tuition, education, and textbook amounts carried forward. Access to your notice of assessment or reassessment online is available through My Account for Individuals.

For slips, if filing electronically, maintain all related documentation. For paper returns, include one copy of each information slip received, indicating income received during the year and associated deductions. Common slips include T4 for employment income, T4A for scholarships, fellowships, and bursaries, and T5 for investment income.

Regarding receipts, if filing electronically, keep them handy. For paper returns, include receipts for claimed amounts.

When it comes to supporting documents, maintain all necessary records if filing electronically. For paper returns, attach completed schedules as required, but refrain from sending supporting documents for amounts claimed on those schedules.

If you have any questions, make sure you contact our office so you don’t miss anything.

When you subscribe to the blog, we will send you an e-mail when there are new updates on the site so you wouldn't miss them.